The software automatically calculates tax, student loan, child support and KiwiSaver deductions, and produces all the reports. Can I use accounting software with payroll software? Most accounting software providers offer their own payroll software or sync with one or more popular payroll providers. Local, state, and federal payroll taxes are automatically calculated, filed, and paid. This is the most common feature we found in payroll software. Collaborations: This allows team members to approve or reject payroll requests. Some payroll software solutions also allow instant messaging and media sharing. This payroll application is only meant to assist you in calculating payroll taxes. You may want to check out more software for Mac, such as Pangea Arcade, CheckMark Payroll or Enigmo 2, which might be similar to Pangea Payroll.

Get recent customer review and rating information on payroll software, along with pricing and answers to common questions for 68 different payroll providers.Updated on July 8th, 2020The SMB Guide is reader-supported. When you buy through links on our site, we may earn anaffiliate commission. Learn moreUpdates:

Updated 22nd of January 2020Reviewed and updated all pricing information.

Updated 23rd of January 2020Added information about recent payroll software trends.

Updated 12th of March 2020We added further details about the benefits of using a payroll system.

Best OverallGusto5.0 out of 5 overallPayroll software allows companies to simplify the task of calculating and distributing employee pay, while adding greater accuracy. While there are both desktop and online payroll software for small businesses, many of the top payroll companies have moved online.

Best Free Payroll Software for 2020 - Detailed Comparisons

Compare free offers from top payroll software makers including Gusto, Payroll4free.com, Zenefits, Fingercheck, and many more. See top features and reviews.

Jul 16, 2020Why We Chose Gusto, Zenefits, and Quickbooks:

To create our rankings we reviewed 68 different payroll software providers, looking at features, pricing, and customer reviews. Ultimately we chose Gusto as our top pick because it offers the most features at a very affordable price.

Among Gusto's stand-out features are FICA Tip Credit claims for restaurants, R&D Tax Credit filing for businesses performing qualified R&D activities, and the ability to allow employees to make charitable donations directly from their paychecks. Unlike most of its competitors, Gusto also offers lifetime accounts.

Gusto includes a number of other specialized features including expense integration, net-to-gross calculations, payroll reminders, and easy payroll cancellations. Users benefit from 256-bit SSL encryption, which safeguards their software against security breaches.

Zenefits came in a close second. It had the largest number of features out of the 70+ software services we reviewed and has a great reputation.

Quickbooks is also a great choice. If you already use their accounting and POS software, you'll definitely want to consider their payroll software, as it will all work together seamlessly.

Check out our table with a complete list of payroll software providers, plus the features that they offer for a more detailed account of our ranking process. For help choosing the best payroll software for your business, read our step-by-step guide on how to choose a payroll software.

How to Choose a Payroll Software

Learn how to choose the right payroll software for your business. Includes our step-by-step guide, features, tips, checklist, and FAQs.

Jul 15, 2020Things to Consider When Evaluating Small Business Payroll Software:

- Not every payroll solution can accommodate multiple payment schedules. If some of your employees are paid on a weekly basis, while others are paid monthly, you'll need to choose software with the appropriate capabilities.

- Payroll solutions are often used in conjunction with other pieces of software, including accounting and time-tracking solutions. Research which integrations you'd like, and whether your preferred payroll software can accommodate these, before making any commitments.

- Your chosen solution will house sensitive company and employee information. If leaked, your business could incur legal, financial, and reputational consequences. Be sure to select for highly secure payroll software; ideally, one protected by 256-bit SSL encryption.

Best Small Business Payroll Software:

Rank

Name

Offer

Review

Learn More

1.

Gusto

$39.00 + $6 /employee /mo.

Affordable option with the most extensive range of capabilities, including rare features like lifetime accounts.

2.

Zenefits

$8.00 + $6.00 /employee /mo. (min. 5 employees)

Most features overall, but doesn't offer unlimited payrolls.

3.

QuickBooks Payroll

$45.00 + $4.00 /employee /mo.

Plans cater to different budgets but don't offer overtime tracking or lifetime accounts.

4.

Fingercheck

$35.00 /mo.

Includes standard features plus less common ones like payroll reminders and the option to pay contractors.

5.

Square Payroll

$29.00 + $5.00 /employee /mo.

User-friendly option that simplifies inventory management but doesn't include an employee database.

6.

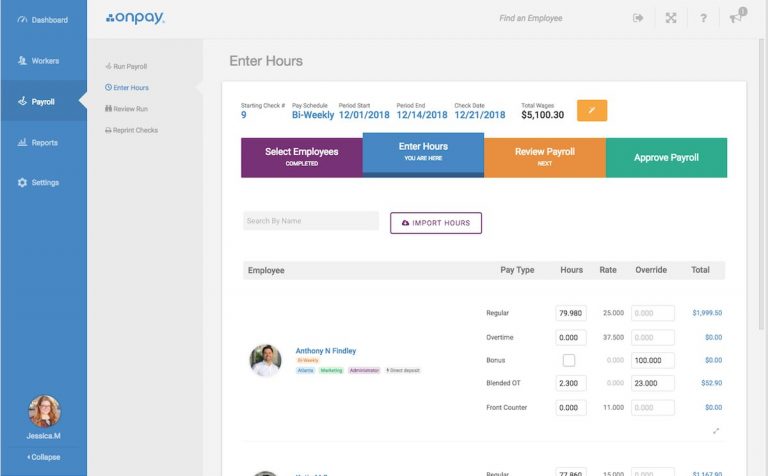

OnPay

$36.00 + $4.00 /employee /mo.

Includes all common capabilities plus advanced features like flexible payment schedules and lifetime accounts.

7.

SurePayroll Inc.

$29.99 + $4.00 /employee /mo.

Offers standard features and some less common ones, including the ability to pay contractors and cancel payrolls.

8.

Xero

$30.00 /mo.

Relatively feature-rich option, but lacks a compliance management tool.

9.

Patriot Software

$10.00 + $4.00 /employee /mo.

Comprehensive software including features like W-2 and 10199 preparation, plus contractor payments.

10.

Paychex Flex

Quote only

Includes most standard features plus some uncommon ones, but missing an overtime tracking tool.

11.

Payroll by Wave

$20.00 + $4.00 per active employee or contractor /mo.

Budget-friendly option that offers an array of functions, but lacking multiple pay rates and garnishments.

12.

UltiPro

$600.00 /yr.

Offers nice-to-haves like payroll reminders and new hire reporting, but lacks W-2 and 1099 preparation.

13.

Wagepoint

$20.00 + $2.00 /employee /mo.

Supports contractor payments and off-cycle payrolls, but lacks an employee database.

14.

PaymentEvolution

$0.00 + ePay transaction fees

A competitively-priced solution that is packed with features, but only available in Canada.

15.

eNETEmployer

$9.95 + $1.30 /employee /pay run

Secure with the option to cancel payrolls easily, but lacks multi-state payroll capabilities.

16.

Sage

$49.95 /mo.

Easy-to-use software that integrates with Sage's accounting solutions, but can be costly.

17.

BambooHR

$8.00

Includes most standard payroll features, but does not support automatic payments or garnishments.

18.

Payroll Mate

$119.00 /yr.

A solid solution that lacks an employee database and mobile access.

19.

BrightPay

$0.00

Offers many features, but missing W-2 and 1099 preparation and payments for workers' compensation.

20.

CheckMark

$429.00 /license

A good solution for companies that don't require a wealth of advanced features.

21.

APS Payroll

$60.00 + $5.00 /employee /mo. (min. spend of $250.00 /mo.)

Includes all common functionalities plus unlimited payrolls, but lacks expense integration.

22.

Justworks

$39.00 /mo.

Supports multiple pay rates and generates payroll reports, but lacks built-in timesheets.

23.

Simple X Payroll

$99.00 /mo. + $3.00 /employee /pay period

Cost-effective solution with features like built-in timesheets and data migration, but lacks time-tracking integrations.

24.

Run by ADP

Quote only

Fast and intuitive software that integrates with other ADP products, but lacks 265-bit SSL encryption.

25.

Viventium

Quote only

Mid-weight option that includes overtime tracking and digital signatures, but not compliance management.

26.

Workday Payroll

$100.00 /employee /yr.

Inexpensive option that includes most standard features and some advanced ones, but no email support.

27.

Cascade HR

Quote only

Includes sufficient features for basic payroll activities, plus the capacity for off-cycle payroll processing.

28.

Namely

$15.00 /mo.

Works well for small businesses but lacks specialized capabilities.

29.

TRAXPayroll

Quote only

Offers a good range of features, but doesn't support automatic payments or accounting integrations.

30.

Symmetry

Quote only

Comprises common features plus nice-to-haves like off-cycle payroll processing, but no phone support.

31.

IRIS

$0.00 /mo.

Offers a generous selection of plans, but doesn't support multi-state payroll processing.

32.

Paycor

$11.15 (based on our research); Contact for Quote

Supports most basic payroll activities and some advanced ones, but lacks leave tracking capabilities.

33.

Simplepay.ca

$2.00 /employee

Features all standard functionalities, but does not integrate with time-tracking or accounting software.

34.

WebPay

Quote only

Secure, but missing standard features such as W-2 and 1099 preparation and the capacity to process reimbursements.

35.

Aruti

Quote only

Includes many common features, but doesn't support direct deposits or automated payments.

36.

AccountEdge Pro

$499.00 for new users; upgrades from $359.00

Provides many standard functionalities, plus chat support, but lacking time-tracking and mobile integrations.

37.

ezPaycheck

$99.00 /yr.

Includes standard features like accounting and time-tracking integrations, but lacks telephonic support.

38.

High Line

Contact for Quote

Missing compliance management features and payroll on autopilot, but includes uncommon features like new hire reporting.

39.

ePayroll

$5.00 /employee /mo.

Offers many standard features but doesn't support automatic payments. Intended for use in Australia.

40.

PenSoft Payroll Solutions

$269.00 /yr.

User-friendly option that includes some uncommon features like data migration, but lacks many standard features.

41.

Salaroo

€3.00 /employee

Offers multiple payment schedules and mobile integration, but missing automated payments and multi-state coverage.

42.

Paybooks

₹1,800.00 /mo.

An inexpensive solution that includes most standard features and is intended for use by Indian businesses.

43.

JustLogin

$5.00 /user /mo.

Intuitive option with many common capabilities, plus calendar integrations, but missing expected functionalities like direct deposits.

44.

Blaeberry

Quote only

Provides many standard features plus some specialized ones, but designed for use in Canada.

45.

PayCheck

Quote only

Offers most common capabilities, including automated taxes and payments, but lacks many standard features.

46.

AmCheck

Quote only

A basic offering that lacks features like accounting, time-tracking, and mobile integrations, plus PTO tracking.

47.

Civica HR

Quote only

Includes most common features plus numerous advanced capabilities, but missing standard capacities like multi-state coverage.

48.

Accent HRP

Payroll Tax Software For Mac

$2,500.00 one-time payment

Supports basic payroll activities, but could benefit from features like built-in timesheets and flexible payment schedules.

49.

PayDirt Payroll

$0.00

Provides most common features plus mobile access, but lacks automatic deductions and email support.

50.

Humanic Payroll

Quote only

Basic solution that integrates with accounting and time-tracking software, but lacks some important functions.

51.

Ramco HCM with Global Payroll Reviews

Quote only

Includes built-in timesheets plus accounting and time-tracking integrations, but missing some standard features.

52.

Sprout HR & Payroll

Quote only

Can support most basic payroll functions, but lacks features like built-in timesheets and accounting integrations.

53.

Spine Payroll Reviews

Quote only

User-friendly option with many common features, but missing direct deposits and check printing.

54.

AME Payroll

$125.00 /mo.

An intuitive and inexpensive options that offers a limited range of features.

55.

Teamspirit

Teamspirit

Adequate in supporting basic payroll activities, but lacks some features and pricing is inflexible.

56.

Dayforce HCM

$10.00 /employee /mo.

Implementation is tricky and the reporting function can be improved, but helps to streamline payroll.

57.

Infinisource

Quote only

Offers a few standard features but lacks payroll automation and the ability to process deductions.

58.

Telleroo

£29.00 /mo.

User-friendly, but lacking some crucial capabilities and only available to UK businesses.

59.

Access Payroll

£2.00 /mo.

A rudimentary option that offers numerous helpful features including built-in timesheets and mobile integration.

60.

Breaktru

$24.95 per download

Basic solution that includes some essential features but lacks multi-state payroll processing capacities.

61.

PayWindow Payroll

$89.95 /yr.

Offers most common features and some advanced ones, but lacks built-in timesheets and expense integrations.

62.

Merit Payroll

Quote only

Lacking most critical features plus many non-essential ones.

Pricing information reviewed on January 22, 2020. Prices for some products may vary by region.Pros and Cons:

Pros

- Run payroll automatically each pay period.

- Ensure accuracy by tracking hours worked, deductions, etc.

- Give employees online access to paystubs.

- Save money by doing payroll yourself instead of hiring an accountant or bookkeeper.

Cons

- Some platforms charge on a per-user basis.

- Specialized features may cost extra.

- Manual entry may still be necessary in some cases.

Gusto Core vs. Quickbooks Payroll Core:

When compared to Quickbooks' Payroll Core, Gusto's Core plan offers more integrations and has better employee portals with complete access to digital paystubs, lifetime accounts, and the ability to file documents using e-signatures. In addition, there is no extra cost for paying contractors using Gusto Core, while Quickbooks charges $14.99 for 3 contractor payments.

Offering

Gusto Core

Quickbooks Payroll Core

Price

$39.00 /mo. + $6.00 /mo. per employee

$45.00 /mo. + $4.00 /mo. per employee

Integrations

Quickbooks, Xero, Freshbooks, TSheets, Homebase, When I Work, and more

TSheets and Quickbooks Accounting

Pay 1099 Contractors

Included

Additional filing fee ($14.99 for 3 contractors)

Lifetime Employee Access

Yes

No

E Signatures

Yes

No

Digital Paystubs

Yes

Yes

Gusto Complete vs. Zenefits Essentials:

Gusto Complete and Zenefits Essentials represent the best combination of value for mixed-user HR and payroll solutions. Although Zenefits charges $6.00 per employee per month for their payroll add-on, you can use it in tandem with their Essential package for a total of $14.00 per employee per month. This gives users access to numerous integrations, compliance help, custom employee handbooks, and more. Gusto complete offers a similar set of features and costs $39.00 per month + $12.00 per employee.

Offering

Gusto Complete

Zenefits Essentials (w/ payroll add-on)

Price

$39.00 /mo. + $12.00 /mo. per employee

$14.00 /mo. per employee

Employee Surveys

Yes

No

Custom Employee Handbook

No

Yes

Integrations

Freshbooks, Quickbooks, TSheets, When I Work, Boomr, and more.

Zapier, Box, Quickbooks, Expensify, JazzHR, and many more.

Automatic Tax Filling

Yes

Yes

Compliance Help

No

Yes

Gusto Concierge vs. Quickbooks Elite:

The Concierge plan is Gusto's top tier. In addition to all of the features included in every other Gusto plan, the Concierge package includes things like HR templates, compliance updates, and dedicated support. By comparison, Quickbooks Payroll Elite includes a customized setup, time tracking, and 24/7 expert product support. Both plans offer superior support compared to more affordable options, but Gusto is obviously more expensive at $149.00 per month plus $12.00 per employee.

Offering

Gusto Concierge

Quickbooks Elite

Price

$149.00 /mo. + $12.00 /mo. per employee

$125.00 /mo. + $10 /mo. per employee

Compliance Assistance

Yes

Yes

Job Description Templates

Yes

No

Payroll Program For Mac

Dedicated Support

Yes

Yes (US customers only)

Free Payroll Templates

Learn about the uses of the different payroll templates. Includes free downloads.

Apr 17, 2020Payroll Feature Glossary:

256-bit SSL Encryption:

This refers to a 256-bit cipher key for encryption on an SSL connection, making data more secure.

Accounting Integrations:

Allows users to integrate major accounting functions onto one systemwith accounting software such as QuickBooks Payroll, Xero, and FreshBooks. This creates a singular portal for all payroll activities, making it easier to compare information across categories.

Activity Dashboard:

The homepage of your payroll software where you can access apps and services, reminders, calendars, to-do lists, employee data, and insights into your payroll data.

All Tax Forms:

Federal, state, and local tax forms are filed on behalf of your business.

Automated Taxes:

Local, state, and federal payroll taxes are automatically calculated, filed, and paid. This is the most common feature we found in payroll software.

Collaborations:

This allows team members to approve or reject payroll requests. Some payroll software solutions also allow instant messaging and media sharing.

Deductions:

Tool for calculating tax and benefits deductions from wages.

Federal R&D Tax Credit:

Tax Software For Mac Computers

R&D tax credit (also known as research and experimentation tax credit) is awarded to businesses that incur expenses from research and development projects in the U.S. This includes wages paid to employees conducting research, money spent on equipment, and payments to energy consortia.

FICA Tip Credit for Restaurants:

FICA Tip Credit is awarded to employers when a server's tips exceed the minimum wage requirements. Tips are considered income tax, so employers are rewarded for reporting all tip earnings as well as benefits and meals.

Garnishments:

Garnishments are a portion of an employee's wages that employers withhold for outstanding, court-ordered payments such as debt and child support. The amount is sent directly to the entity.

Integrated Pre-Tax Benefits:

Money is deducted from employees's wages before taxes, and is put towards benefits.

Multiple Pay Rates:

Tool for paying an employee multiple rates for various jobs they perform for the business.

Net-to-Gross Calculations:

Tool for calculating gross wage payments before taxes, based on net payment amounts.

Payroll Reports:

Payroll reports are submitted to notify the government of tax liabilities. The payroll report should include bank transactions, deductions, taxes, and paid time off.

Reimbursements:

Allows employees to be reimbursed for business-related expenses such as travel costs and off-site meetings.

SuperStream Compliant:

SuperStream is a mandatory system used by Australian employers to make their compulsory superannuation guarantee payments for employees.

Time-Tracking Integrations:

Imports data on employees's hours with time-tracking systems.

Unlimited Bonus and Off-Cycle Payrolls:

Allows one-off payments like bonuses to be processed without tax deductions.

Benefits of a Payroll System:

- Run payroll automatically at pre-determined intervals.

- Easily add, edit and save employee information.

- Give employees access to digital paystubs.

- Save time.

- Administer payroll yourself instead of hiring a payroll manager.

- Generate payroll reports.

- Store payment records in the cloud.

What is the Easiest Payroll Software to Use?

Most users report the leading platforms like Gusto, Quickbooks, and OnPay are all easy to use. This is because they have intuitive interfaces and are designed to be used by people who have little to no background in payroll. This is ideal for small business owners who want to do their own payroll quickly since all they have to do is enter their employee information and payment preferences.

Payroll Software Trends:

AI could be used to manage compliance.

Payroll platforms are beginning to integrate AI as a means of automating compliance management for customers. Machine learning makes it possible for AI systems to gather rules and regulations and apply them to data sets in order to limit human error. HRMonline.com also suggests that AI could be used to monitor all data in a payroll system and make efficiency suggestions to managers.

One good example of this is Alight Solutions, a payroll tech provider that recently launched a virtual assistant called Eloise. Eloise has the ability to aggregate and analyze payroll data so that employers can minimize errors and maximize efficiency.

We expect to see more developments like this in the near future as the rapid advancement of AI and machine learning presents a unique opportunity for payroll management tools.

FAQs:

How much does payroll software cost?

The base cost for small business payroll software is between $6.00 and $49.99 per month or more, depending on the number of employees you have and the features that you need.

What software do you use for payroll?

The most popular payroll software solutions include Gusto, Zenefits, and Quickbooks.

Where can I find payroll software for Mac computers?

Any online payroll software will work on a Mac. There are fewer offline payroll options all the time, but check out the App Store to see some of what's available.

Is there a cheap payroll software for small businesses?

- Gusto.

- Payroll4Free.com.

- Payroll by Wave.

- PayDirt Payroll.

- SurePayroll.

- CheckMark.

- QuickBooks Payroll.

- Xero.

What are some payroll software providers for accountants?

- CheckMark.

- Denali Payroll.

- Gusto.

- OnPay.

- Patriot Software.

- Quickbooks.

Is it still possible to get pay check printing software?

Yes. Even though more and more people are switching to direct deposit and totally digital payroll solutions, companies like Gusto, Zenefits, and QuickBooks Payroll still make it possible for you to print checks.

What are the best payroll software providers for large companies?

- UltiPro.

- PlanDay.

- Kronos.

Is it still possible to find offline payroll software?

Yes, although it's getting harder. You can check out VersaCsheck payroll software as one alternative.

What is the best small business payroll software for restaurants?

- SurePayroll.

- Xero.

- Square Payroll.

- Gusto.

- Quickbooks.

Is there a simple payroll software small businesses can use with a short learning curve?

Yes. Xero, QuickBooks Payroll, BrightPay, and Payroll Mate all get high marks for ease of use. Most payroll software vendors will let you have a demo or free trial to see what it's like to use.

Are there any open source payroll software options?

Yes, there are a few, including TimeTrex and OrangeHRM.

What are the different types of payroll software?

- Free.

- Paid.

- Open-source.

- Web-based (online).

- Offline.

- For accountants.

- For enterprise.

- For small businesses.

Payroll Software For Mac Reviews

Is there an online accounting software with payroll?

Payroll For Mac

Yes. There's Xero, Quickbooks, Wave, and AccountEdge Pro.

Is there a basic payroll software that can handle time tracking/attendance?

Yes, there are several accounting and payroll software companies that make attendance payroll software, including Quickbooks, Sage, and AccountEdge.

Payroll Tax Software For Mac Download

Which payroll system is best?

- Gusto.

- QuickBooks Payroll.

- Sage 50cloud.

- OnPay.

- Xero.

- Wave.